The training company may charge for the hours worked by instructors in preparation and delivery of the course, plus a fee for the course materials. A high operating leverage indicates that a company has a larger portion of fixed costs compared to variable costs, making it more sensitive to changes in sales. As sales increase, the company can generate a higher profit margin due to the reduced impact of variable costs on total expenses. Conversely, a decrease in sales, without adequately reducing fixed costs, can lead to a significant decline in profits.

Is the cost accountant responsible for determining what is and isn’t direct material?

In summary, understanding and managing fixed and variable costs is paramount to conducting accurate financial analysis and enhancing a company’s performance. By leveraging various tools such as operating leverage, break-even analysis, and key financial ratios, businesses can make informed decisions that lead to long-term success. Marginal cost analysis is another essential aspect of financial management. Marginal cost refers to the additional expense incurred for producing one more unit of output. Monitoring marginal costs enables businesses to adjust production levels on-demand to optimize profitability. Another ubiquitous example of indirect fixed cost is the rental expense of office blocks (not of the production block).

- Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions.

- Variable costs are expenses that change in proportion to the volume of goods or services a business produces.

- Keeping track of product costs is critical for pricing and cost control.

Are direct costs fixed and indirect costs variable?

To identify direct materials, cost accountants typically review bills of materials (BOMs) or other documentation that lists the components or parts required to produce a finished product. By analyzing this information, the cost accountant can determine which materials are direct materials fixed or variable are directly tied to the production of the finished product and, therefore, should be classified as direct materials. By following these steps, cost accountants can better understand direct materials and their impact on the overall cost of a product or service.

Cost Behavior and Decision Making

The price of a greater amount of goods can be spread over the same amount of a fixed cost. In this way, a company may achieve economies of scale by increasing production and lowering costs. Fixed costs remain the same regardless of whether goods or services are produced or not.

Using direct costs requires strict management of inventory valuation when inventory is purchased at different dollar amounts. For example, the cost of an essential component of an item being manufactured may change over time. As the item is being manufactured, the component piece’s price must be directly traced to the item.

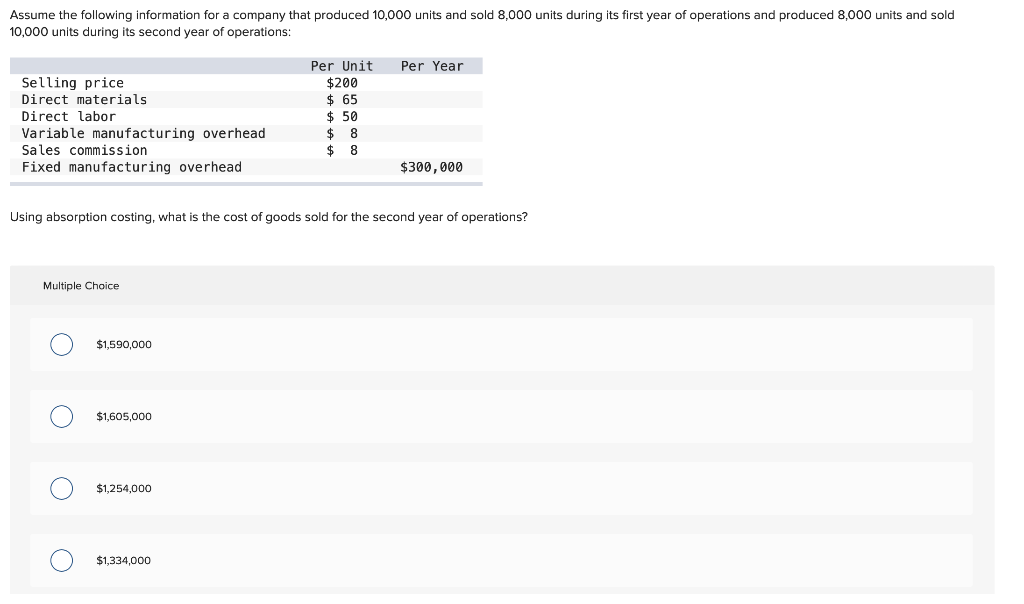

Any company can use both methods for various reasons but public companies are required to use absorption costing due to their GAAP accounting obligations. This formula helps businesses determine the expenses directly related to the production or sales volume of their products or services. As a result, effective management of variable costs can lead to improved profitability and long-term success. By understanding how variable costs impact various industries, businesses can effectively manage expenses and implement strategies to reduce costs, thereby increasing profitability.

By lowering variable costs, businesses can improve their bottom line and maintain competitiveness in the market. Alternatively, take an example of a retail store which is in the trading business, i.e., it would buy products and then sale ahead without any modification. The direct cost for the retail industry is the cost of the purchase of those products. However, once any product is sold, it is usually handed over to the customer in a polythene bag.

Marginal costs can include variable costs because they are part of the production process and expense. Variable costs change based on the level of production, which means there is also a marginal cost in the total cost of production. If the cost object is the production department, the direct and indirect department costs are likely to be partly fixed and partly variable. For example, the production department has it own electric meter to measure the electricity used to operate its equipment. Therefore, the electricity cost is a direct production department cost that is variable since it changes with the volume of products manufactured. On the other hand the salaries of the production department supervisors are a direct production department cost that is fixed.